Uniswap’s UNI is trading just under a key breakout line as on-chain activity stays firm and leveraged traders continue to add positions. UNI held near $5.6 on January 14, with markets once again testing the $5.7 region after last week’s pullback. The token has struggled to push back into the mid-$5.50s to $5.60s range, which …

Uniswap (UNI) Tests Key Resistance: Is a 30% Breakout Rally Imminent?

Uniswap’s UNI is trading just under a key breakout line as on-chain activity stays firm and leveraged traders continue to add positions.

UNI held near $5.6 on January 14, with markets once again testing the $5.7 region after last week’s pullback.

The token has struggled to push back into the mid-$5.50s to $5.60s range, which traders have treated as a short-term ceiling.

This slow move comes after UNI slipped below $5.72 in early January. That level marked the lower edge of a December range.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

UNI Price Prediction: Is Uniswap (UNI) Forming a Base After Weeks of Decline?

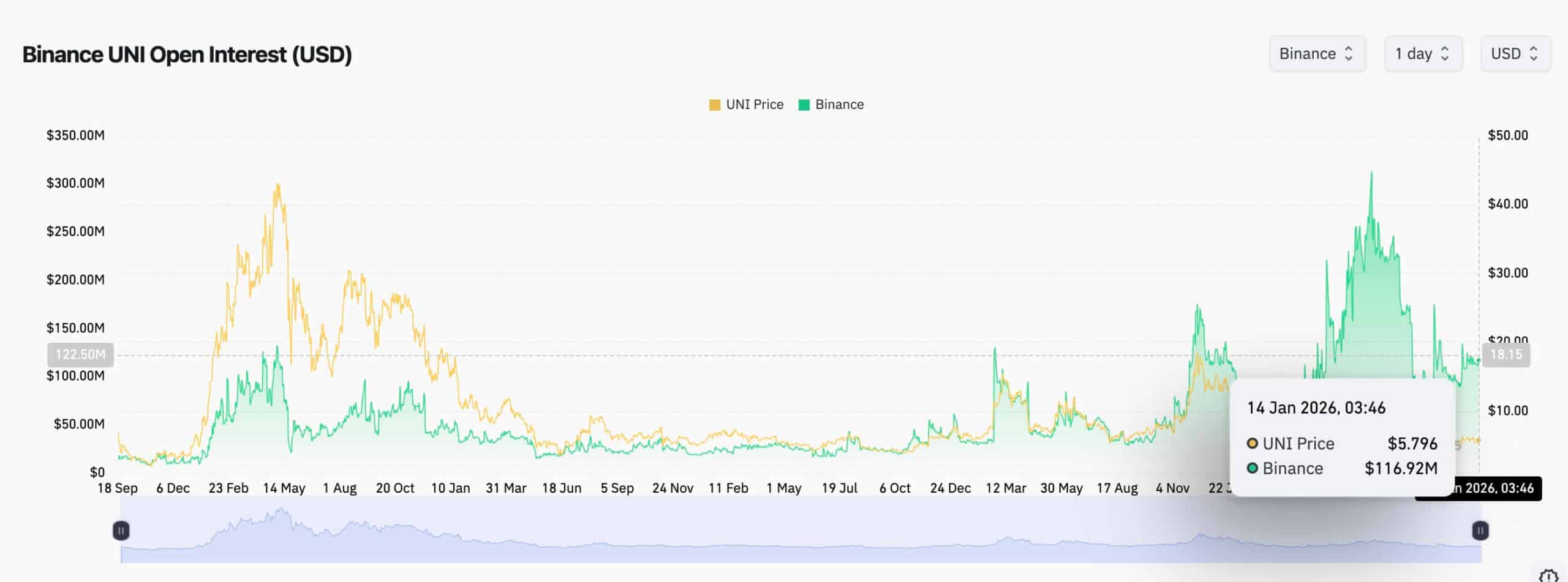

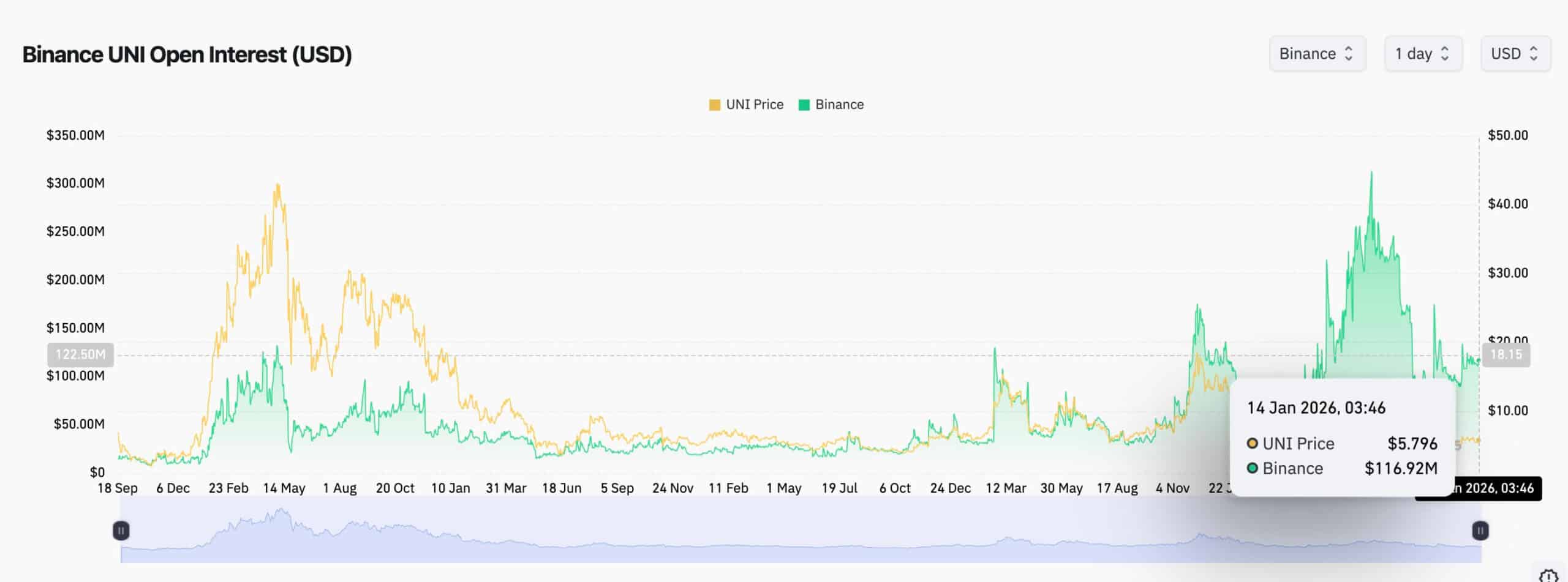

CoinGlass data shows UNI futures open interest at about $411M, with roughly $423M in futures trading volume over the past 24 hours.

Traders appear active, even as spot price struggles to reclaim lost ground.

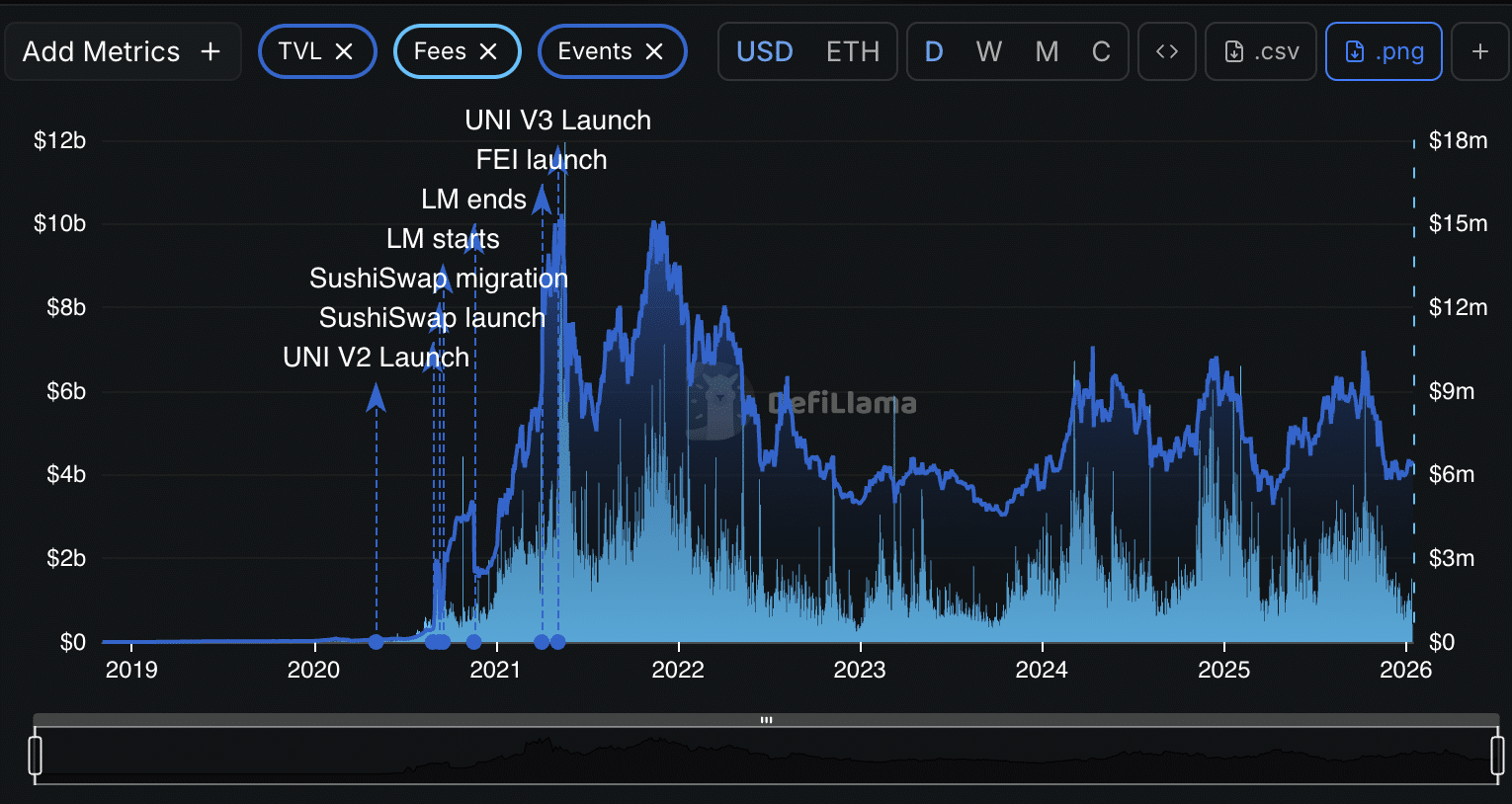

On-chain data shows Uniswap still leading decentralized spot trading. DefiLlama’s data shows Uniswap’s DEX volume at about $1.9 billion over the past 24 hours, the highest among major platforms.

Fees have held up even while UNI’s price has moved sideways. DefiLlama data for Uniswap v3 shows roughly $1.0M in fees in the last day and about $6.1M over the past week.

Actual protocol revenue is much lower. That gap reflects how most fees go to liquidity providers, not the protocol itself.

The near-term picture is mixed. In the US, Bitwise has filed for several single-asset “strategy” ETFs, including one linked to UNI, based on SEC filings and earlier reports.

Whether those filings turn into approvals or spark fresh demand is still unclear.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2026

Is Uniswap (UNI) Stabilizing After Defending the $5.50 Support Zone?

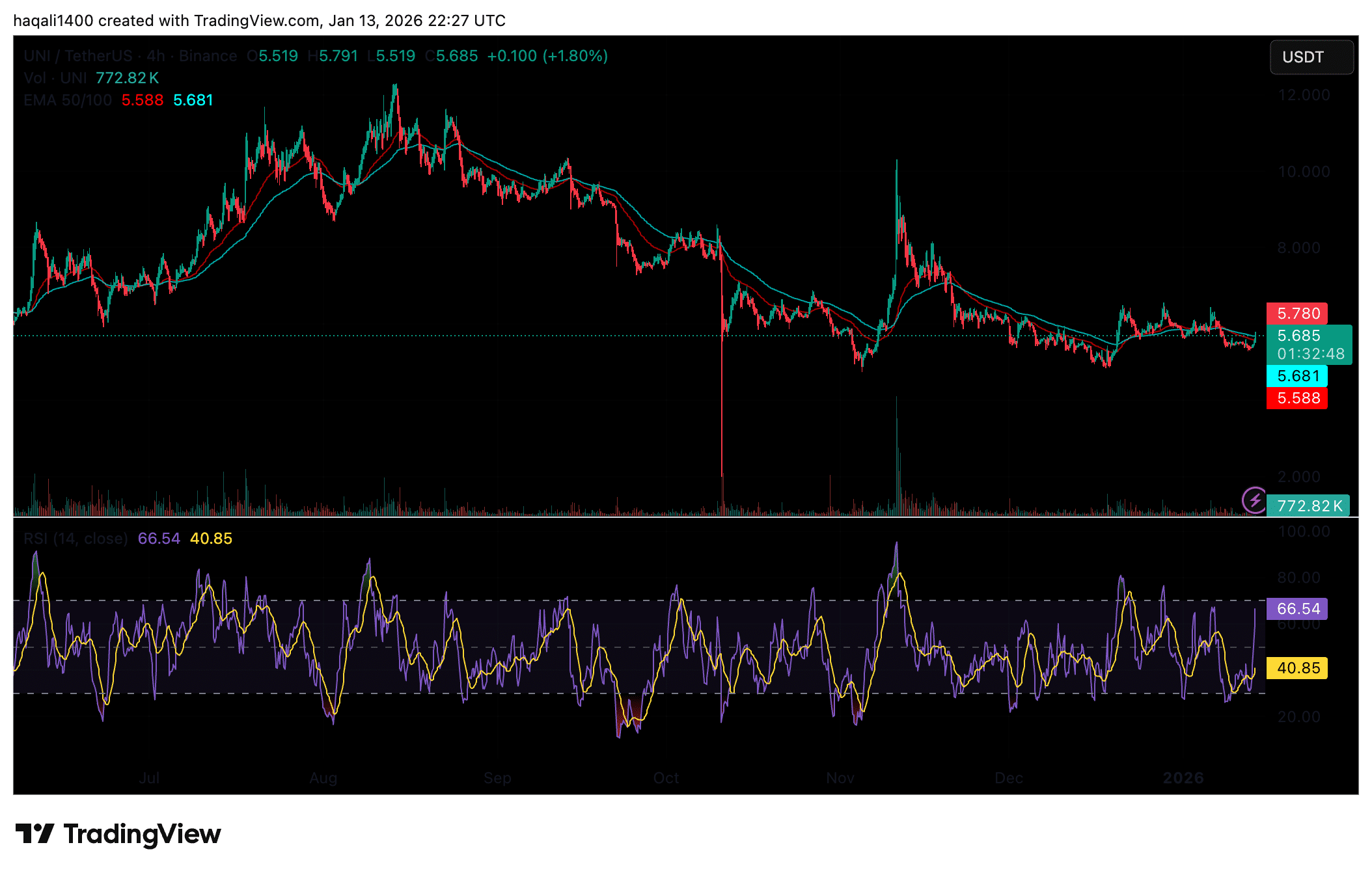

Uniswap (UNI) is starting to steady after weeks of weak price action, based on the 4-hour UNI/USDT chart dated Jan. 13.

As per Tradingview data, The token is trading near $5.68 after holding the $5.50–$5.60 support area several times. That zone has acted as a floor during a long stretch of lower highs that began when UNI slipped from the $9–$10 range in November.

UNI is still in a broader downtrend. Price remains below the 50-period and 100-period EMAs, both of which continue to slope downward.

But the distance between price and these moving averages is shrinking, which shows sellers are losing strength. A clear move above $5.80–$6.00 would be the first sign of a short-term shift.

Momentum signals are mixed but improving. The RSI is sitting around 66 after climbing from mid-range levels. It’s not overbought yet, which leaves room for a push higher if trading volume picks up.

For now, UNI is stuck in a tight range between $5.50 support and $5.90 resistance. A breakout on either side will likely set the tone for the next move.

DISCOVER: 10+ Next Crypto to 100X In 2026

Key Takeaways

The post Uniswap (UNI) Tests Key Resistance: Is a 30% Breakout Rally Imminent? appeared first on 99Bitcoins.