Is the next altseason truly upon us, or are we just reading too much into a few green candles? For seasoned investors and casual crypto followers alike, the question resurfaces like clockwork each time the altcoin market shows signs of life. In 2025, with macroeconomic shifts, evolving blockchain ecosystems, and new capital inflows, the chatter …

Altseason or False Alarm? Decoding Market Indicators

Is the next altseason truly upon us, or are we just reading too much into a few green candles? For seasoned investors and casual crypto followers alike, the question resurfaces like clockwork each time the altcoin market shows signs of life. In 2025, with macroeconomic shifts, evolving blockchain ecosystems, and new capital inflows, the chatter around an impending altseason has once again reached fever pitch. But beneath the noise, what do the market indicators actually reveal?

The Anatomy of an Altseason

Before diving into the metrics, it’s important to understand what constitutes an altseason. An altseason—short for altcoin season—is a market phase where alternative cryptocurrencies outperform Bitcoin in terms of price appreciation, volume, and market cap dominance.

Historically, altseasons tend to follow periods of sustained Bitcoin growth. As BTC consolidates, investors shift focus to lower-cap tokens in pursuit of higher returns. However, this isn’t a random phenomenon; it often coincides with broader sentiment changes, technical breakouts, and liquidity redistributions.

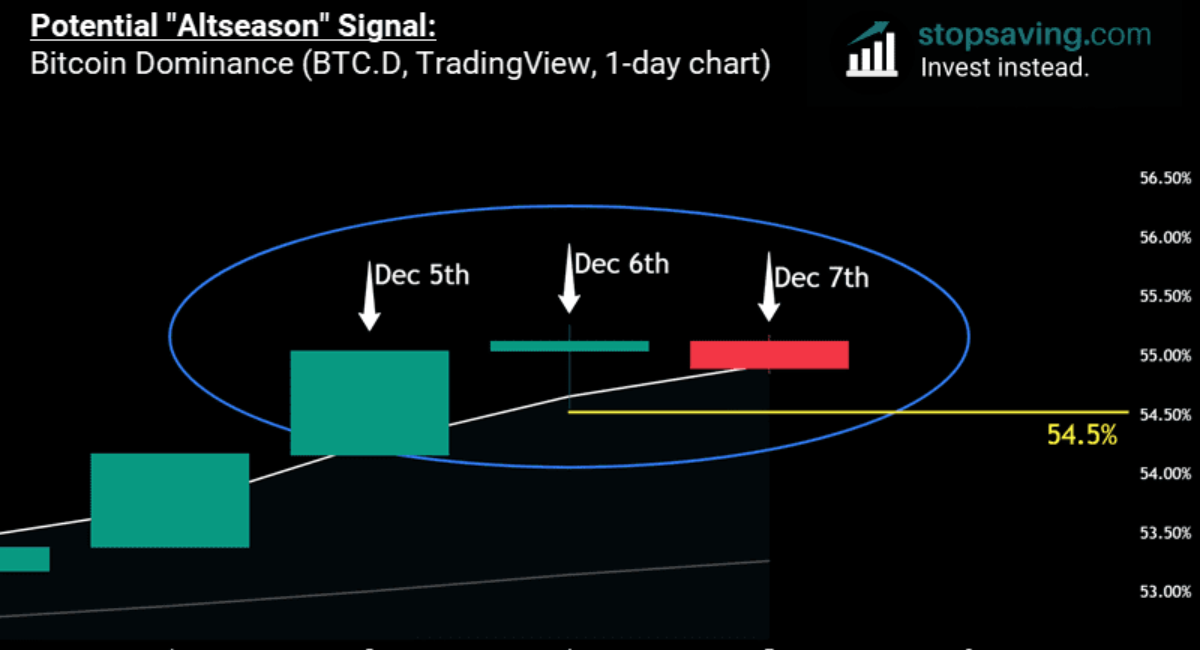

Indicator 1: Bitcoin Dominance Ratio (BTC.D)

One of the most widely referenced metrics in predicting altseason is the Bitcoin Dominance Index, which measures BTC’s market cap relative to the entire crypto market.

- A declining BTC dominance typically indicates capital is rotating into altcoins.

- In contrast, rising dominance reflects a “flight to safety” back into Bitcoin.

As of Q3 2025, Bitcoin dominance has hovered between 47–50%, slightly down from its post-halving high earlier in the year. This dip has triggered speculation that investors are reallocating into Ethereum, Solana, and smaller-cap Layer 2 and AI-centric tokens.

Verdict: This indicator leans toward altseason potential but isn’t yet screaming confirmation.

Indicator 2: Trading Volume and Market Liquidity

In any market cycle, volume precedes price. During true altseasons, we see a surge in trading volumes across multiple altcoin pairs, not just in top 10 tokens.

Right now, data from major exchanges like Binance, Coinbase, and OKX shows:

- Increased daily volume on altcoin pairs like ETH/SOL, ARB/USDT, and INJ/BTC.

- Emergence of new breakout tokens in DePIN, RWA (real-world assets), and gaming sectors.

However, total liquidity remains fragmented. While blue-chip altcoins have strong order books, low-cap tokens are still vulnerable to volatility due to limited depth. This suggests a selective altcoin rally, not a broad-based altseason.

Verdict: Encouraging volume on major alts, but lacking widespread liquidity surge to confirm a full-scale altseason.

Indicator 3: Ethereum Performance Relative to Bitcoin (ETH/BTC)

Ethereum often leads the altcoin rally. A rising ETH/BTC ratio is a classic early signal that alts might outperform Bitcoin.

Currently, the ETH/BTC pair is showing a gradual uptick, trending near a key resistance zone. This aligns with Ethereum’s recent narrative strength post-Dencun upgrade and growing adoption in enterprise blockchain use cases.

If ETH decisively breaks above this level, it could catalyze capital flows into broader Layer 1 and Layer 2 ecosystems.

Verdict: ETH/BTC momentum supports an altseason narrative, but watch for breakout confirmation.

Indicator 4: Social Sentiment and Search Trends

Social media trends and Google search volumes are often dismissed as noise, but they provide a glimpse into retail investor psychology, which plays a major role during speculative rallies.

According to data from LunarCrush and Santiment:

- Mentions of “altseason,” “next 100x coin,” and “low cap gems” are rising steadily on platforms like X (formerly Twitter) and Telegram.

- NFT-related tokens and AI-integrated projects are generating renewed buzz.

Still, we haven’t seen the FOMO-driven frenzy typical of historical altseasons, where meme tokens double overnight and random tokens appear in trending tabs.

Verdict: Sentiment is heating up, but not boiling. We’re in the early innings—if at all.

Indicator 5: Institutional Interest and Smart Money Movement

Smart money isn’t just chasing meme tokens. On-chain data reveals institutional wallets accumulating strategic altcoin positions—particularly in sectors like real-world assets (e.g., Centrifuge, Ondo), Layer 2 scaling (e.g., Optimism, zkSync), and decentralized data oracles.

Additionally, venture capital activity is resurging in Web3 infrastructure, which often precedes strong altcoin rallies as projects begin shipping products post-funding rounds.

On-chain metrics from platforms like Nansen and Arkham Intelligence also show accumulation clusters forming around select altcoins—notably STARK, ARB, and PYTH.

Verdict: Institutional positioning signals confidence in medium-term altcoin growth, though full-scale deployment is still cautious.

What Could Trigger a Confirmed Altseason?

Even with positive indicators, the market may still be on the edge of a breakout rather than in one. A few possible catalysts that could tip the scale include:

- Bitcoin Range-Bound Stability: If BTC consolidates between $65K–$70K, altcoins could thrive in its shadow.

- Major Ethereum Catalyst: The next ETH upgrade or a surprise ETF approval could reignite attention on Layer 1s and beyond.

- Macro Clarity: Easing interest rates or regulatory green lights for crypto projects could unlock sidelined capital.

Final Thoughts: A Mini Altseason, Not a Mania (Yet)

So, is it altseason—or just a mirage?

Current indicators point to a mini altseason in progress, particularly in high-conviction ecosystems. We’re seeing strong rotation into quality altcoins, but the kind of euphoric blow-off top that defines traditional altseasons hasn’t materialized.

For now, it’s a market for the selective, not the speculative. Traders and investors would do well to follow the data—not the dopamine—and focus on fundamentals, liquidity, and narrative strength.

As always in crypto, timing the cycle is half art, half science. Stay nimble, stay informed, and let the indicators—not emotions—guide your next move.