Introduction: When Silence Speaks Louder than the Surge The crypto market is known for its breakneck pace, dramatic price swings, and 24/7 activity. So, when trading volumes start tapering off across major exchanges, it’s hard not to ask — is this a sign of impending collapse, a temporary lull, or something more fundamental? In 2025, …

Liquidity Crunch or Market Maturity? Analyzing Trading Volumes Across Major Exchanges

Introduction: When Silence Speaks Louder than the Surge

The crypto market is known for its breakneck pace, dramatic price swings, and 24/7 activity. So, when trading volumes start tapering off across major exchanges, it’s hard not to ask — is this a sign of impending collapse, a temporary lull, or something more fundamental? In 2025, the crypto landscape is vastly different from its 2017 or 2021 avatars. Fewer retail frenzies. More institutional participants. And an increasing number of market observers are asking: Is the drop in exchange volume a liquidity crunch or the natural sign of a maturing market?

Let’s unpack the numbers, the psychology, and the possibilities.

A Look at the Numbers: What’s Actually Happening?

Across leading centralized exchanges (CEXs) like Binance, Coinbase, Kraken, and Bybit, trading volumes have dipped anywhere from 25% to 60% compared to the bull market highs of late 2021 and early 2024. Even decentralized exchanges (DEXs) such as Uniswap, Curve, and PancakeSwap show lower activity despite broader Ethereum and multichain adoption.

- Binance: From nearly $100B in daily spot and derivatives volume during the bull run to around $35B in 2025.

- Coinbase: Retail-driven trading is down by 40%, though custody and institutional demand are more stable.

- DEXs: Combined volume has dropped from ~$5B/day to under $2B on average.

While numbers have certainly cooled off, volatility-adjusted trading suggests a more nuanced picture. What looks like a “dry spell” could just be a reversion to sustainable, non-speculative behavior.

Liquidity Crunch: Real Threat or Overstated Fear?

A liquidity crunch refers to a scenario where buying and selling becomes harder without affecting prices — a trader’s nightmare. It often occurs when market makers retreat, retail interest wanes, and token volumes concentrate in fewer hands. There are signs this could be happening:

- Thin order books: For mid-tier altcoins, spreads are widening. Even modest buy/sell orders move the market.

- Declining stablecoin reserves: USDT and USDC inflows onto exchanges are lower, signaling less dry powder for trading.

- Fewer new participants: On-chain metrics like wallet creation and KYC registrations are plateauing.

However, it’s essential to ask — are we confusing less speculation with illiquidity?

The Case for Market Maturity: The Calm After the Storm

After three major bull-bear cycles, crypto might finally be growing up. A maturing market is marked by less hysteria, more consistency, and institutional patience. There’s growing evidence to suggest that what we’re seeing is not a collapse but an evolution.

🔹 1. Institutional Dominance Rising

Hedge funds, pension managers, and sovereign wealth funds now account for a significant slice of crypto volume. They don’t day-trade — they accumulate, hedge, and hold. This shift from millions of retail trades to thousands of institutional-sized positions inherently reduces volume while increasing market depth and predictability.

🔹 2. Shift from Hype to Utility

Trading volume is a speculative metric. Real-world adoption isn’t. Platforms like Chainlink, Arbitrum, and Avalanche are seeing usage in enterprise integrations and DeFi infrastructure — not just token swaps. This change reduces noise in the data and reflects an ecosystem that’s working beneath the surface.

🔹 3. Layer 2 Migration and Fragmented Liquidity

With Layer 2s like Optimism and Base gaining traction, liquidity is no longer concentrated on a few chains or exchanges. Fragmentation leads to an apparent volume drop on legacy platforms but doesn’t signal retreat — just redistribution.

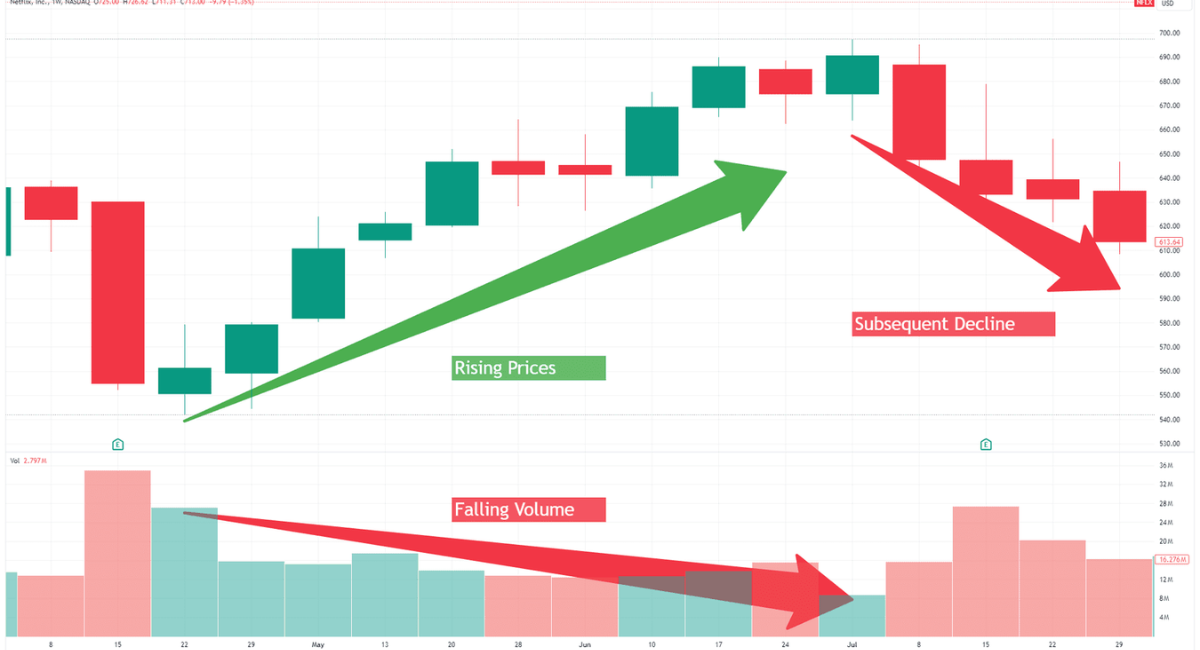

A Behavioral Shift: From FOMO to Fundamentals

During bull runs, traders operate on momentum — the “buy high, sell higher” psychology. That drives massive volumes as people chase pumps. But now, sentiment is more value-driven, focused on real utility, staking rewards, and governance. This behavioral shift is healthier for the long-term ecosystem but less sexy in terms of daily trade numbers.

Even NFTs and gaming tokens — once responsible for frantic trades — are moving toward sustainable user models rather than hype-based flipping.

The DEX Angle: Are We Misreading the Signs?

Decentralized exchanges (DEXs) are particularly interesting. While overall volumes have shrunk, the number of unique users has remained steady or even increased. This suggests users are still transacting — just smaller, more purposeful trades rather than whale-dominated cycles.

Also, with intent-based trading (like what CoW Protocol and Flashbots are experimenting with), many trades never even hit the public order book — making metrics less transparent.

So… What’s Really Going On?

Let’s summarize the possibilities:

| Symptom | Liquidity Crunch? | Market Maturity? |

|---|---|---|

| Lower daily trading volume | ✅ | ✅ |

| Wider bid-ask spreads | ✅ | ❌ (for majors) |

| Declining retail activity | ✅ | ✅ (by design) |

| Institutional rise | ❌ | ✅ |

| Utility-focused behavior | ❌ | ✅ |

The evidence leans more toward market maturity with pockets of thin liquidity, especially in riskier altcoins. Bitcoin, Ethereum, and top tokens remain liquid, and infrastructure improvements are absorbing some of the trading noise that used to dominate headlines.

Conclusion: The Sound of Silence — A Good Thing?

Just because the market is quieter doesn’t mean it’s broken. In fact, low noise can mean strong signal — the signal of serious builders, long-term holders, and smart capital. If 2021 was the casino, 2025 may be the stock exchange. And that’s not a downgrade — it’s an upgrade in disguise.

So, the next time you check CoinGecko or CoinMarketCap and see flat lines and lower volume bars, don’t panic. Pause. Consider whether the market is catching its breath or stepping into a more professional era.

Because in crypto, still waters often run deep.